Effective Forex Day Trading Strategies for Success

Forex day trading can be both exhilarating and daunting for many traders. The ability to capitalize on small price movements in the currency market can lead to significant profits, but it also requires a well-thought-out strategy and disciplined execution. Whether you are a beginner or an experienced trader, understanding and implementing effective forex day trading strategies Best Saudi Brokers strategies can drastically improve your success rate. In this comprehensive article, we will explore various day trading strategies, their pros and cons, and how to apply them in a practical context.

Understanding Day Trading in Forex

Day trading is a style of trading that involves buying and selling financial instruments within the same trading day. Traders typically look to take advantage of short-term price movements and close all positions before the day ends to avoid overnight risk. In the forex market, which operates 24 hours a day, day trading can provide unique opportunities due to the constant fluctuations in currency values.

Key Principles of Day Trading

Successful forex day trading requires a solid understanding of market dynamics and a disciplined approach. Here are some key principles to keep in mind:

- Risk Management: Always use stop-loss orders to protect your capital. Determine your risk tolerance and stick to it.

- Leverage: Use leverage wisely. While it can amplify profits, it also increases the risk of significant losses.

- Market Analysis: Utilize both technical and fundamental analysis to make informed trading decisions.

- Trading Plan: Develop a well-defined trading plan and adhere to it without deviating based on emotions.

Popular Day Trading Strategies

Here are several strategies that forex day traders commonly use:

1. Scalping

Scalping is a strategy that involves making numerous trades in a single day to benefit from small price changes. Traders aim to ‘scalp’ small profits throughout the day. Scalping requires a solid understanding of the forex market and significant time commitment, as traders often need to monitor their charts closely.

2. Momentum Trading

This strategy involves identifying a currency pair that is moving significantly in one direction and entering the trade to ride the trend. Momentum traders use technical indicators, such as Moving Averages or the Relative Strength Index (RSI), to identify potential entry and exit points.

3. Range Trading

Range trading is based on the idea that prices often move within a certain range. Traders look for currency pairs that are oscillating between support and resistance levels. When the prices approach the support level, traders buy, and when they reach the resistance level, they sell.

4. Breakout Trading

Breakout trading focuses on identifying key levels at which price breaks out of a range. Traders enter positions when the price trends outside a previous high or low, expecting momentum to continue in the direction of the breakout.

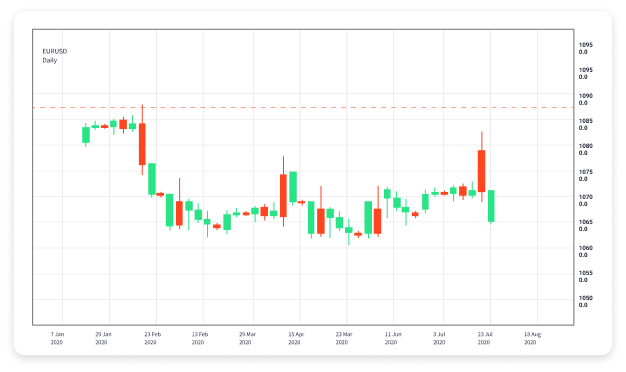

Choosing the Right Currency Pairs

Not all currency pairs are created equal when it comes to day trading. Beginners may want to focus on major currencies such as EUR/USD, USD/JPY, and GBP/USD, as they tend to have high liquidity and lower spreads. Additionally, trading during major market sessions can provide better opportunities and volatility.

The Importance of Technical Analysis

Technical analysis plays a crucial role in day trading. Traders use charts and indicators to analyze price movements and trends. Some widely used indicators include:

- Moving Averages: Helps smoothen price data over a specified time frame.

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements.

- Bollinger Bands: A volatility indicator that shows the upper and lower limits of price movements.

Mindset and Discipline in Trading

Emotions can significantly impact trading decisions. Therefore, maintaining a disciplined mindset is essential for success in day trading. Traders must manage their expectations, accept losses, and avoid revenge trading. Keeping a trading journal can also help track performance and improve strategies over time.

Setting Up Your Trading Environment

A conducive trading environment is vital for making informed decisions. A reliable trading platform with real-time data, good execution speed, and minimal downtime is essential. Additionally, utilizing multiple monitors can enhance your ability to analyze charts and track developments across different currency pairs simultaneously.

Conclusion

Forex day trading can be a rewarding career choice for those willing to put in the time and effort required to develop their skills and strategies. By adhering to sound trading principles, utilizing effective day trading strategies, and maintaining discipline, traders can enhance their likelihood of success in the forex market. Remember that every trader has their unique style, and finding the strategy that suits you best will take time and practice, but the right approach can lead to significant financial rewards.

Resources for Further Learning

Continuous learning is vital in the ever-evolving world of forex trading. Consider exploring online courses, webinars, and trading forums to enhance your knowledge and connect with other traders. Always stay updated on market trends and economic news that could affect your trading strategies.