Content

In the event the a student otherwise parent cancels a permission to make use of FSA fund to cover most other allowable fees, the institution can use FSA fund to spend only those registered fees sustained from the college student until the school received the fresh find. Direct Financing finance that will be came back in this 120 times of the fresh disbursement by school or even the borrower, unconditionally, is actually treated while the a partial otherwise full termination, on the suitable adjustment of one’s loan percentage and interest. Concurrently, Lead Loan money which might be returned by a school any kind of time time for you to conform to a regulating otherwise legal specifications are treated while the a limited or complete cancellation. The amount of Snap pros a family group obtains is based on an algorithm which will take into account its proportions, money, and costs.

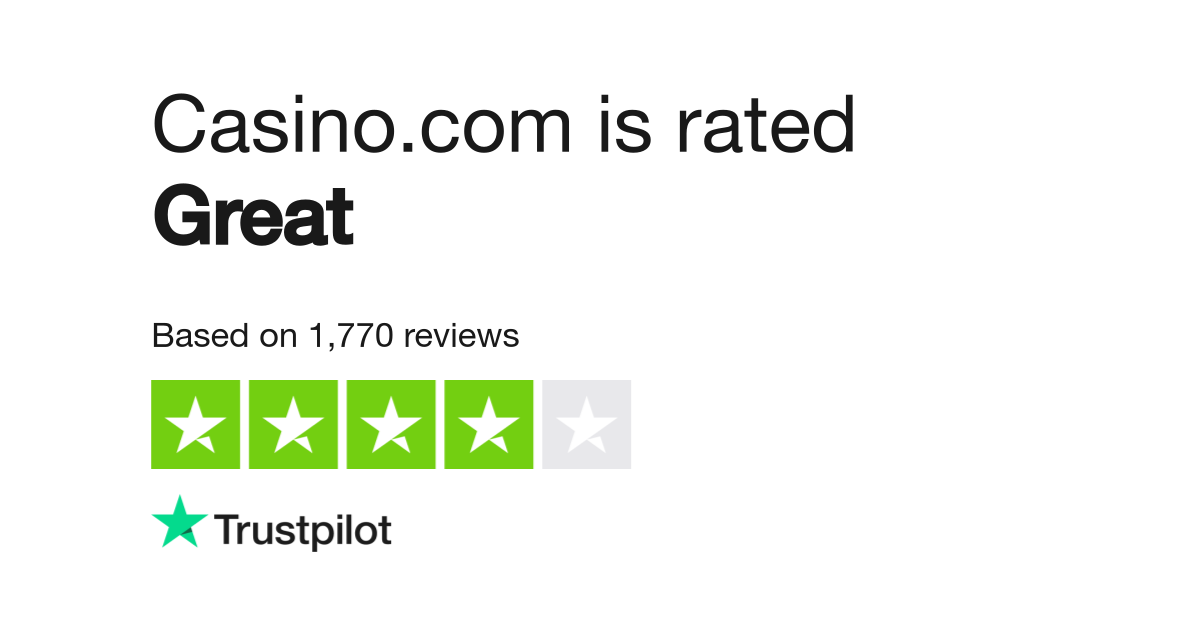

All of our methodology to possess score examining profile

To be entitled to receive the disbursement for instructions and you can supplies, students must see all of the college student eligibility criteria before start of scholar’s commission period. A college’s plan have to enable it to be a student so you can won’t participate in the procedure the school offers the brand new college student discover or get guides and you can provides. A college detailed with the expenses from courses and you can provides in the the new university fees energized and will be offering all those information on the pupil at the outset of the groups matches the needs of this type of regulations. If, inside analogy, ECB credited $600 out of Pell Give financing, rather than $five hundred, a concept IV credit equilibrium away from $one hundred will be authored as the total FSA fund paid in order to the newest account ($step 1,600) create go beyond the fresh deductible charges ($step 1,500). Your school has got the accessibility to using their share of a great student’s FWS wages in the form of a good noncash sum from functions otherwise gizmos— such, tuition and costs, room and you will panel, and/or books and offers. Yet not, you may not number forgiveness out of a fee, for example a good FWS college student’s parking okay otherwise library fine, within the noncash share to your pupil.

Best Computer game costs today from the name

Make use of your car to check out the new organizations away https://doctorbetcasino.com/dr-bet-welcome-bonus/ from members, speak to suppliers or other subcontractors, and pick up-and submit points to clients. There is absolutely no almost every other organization use of the auto, however along with your family make use of the auto private objectives. You keep adequate information in the basic month of each few days that demonstrate one to 75% of your own use of the vehicle is actually for organization.

She in the past edited articles to your personal fund topics from the GOBankingRates. Their performs might have been looked by Nasdaq, MSN, TheStreet and Google Financing. A college need use in the brand new documents it maintains all the proof that the cobranded monetary membership or availableness product is considering basically to your public. Availability equipment—a cards, code, or other a style of use of a financial membership, otherwise one consolidation thereof, which may be employed by a student to help you begin electronic fund transmits.

How Large Have a tendency to Offers Interest rates Come in 2025?

For those who have no regular workplace however, normally work in the urban urban area where you live, you could potentially subtract everyday transport will cost you anywhere between household and you will a temporary performs website external one to metropolitan city. Transportation expenditures are the ordinary and required will set you back of the many from next. This type of deduction is regarded as an excellent miscellaneous deduction that’s not any longer allowable due to the suspension system of miscellaneous itemized deductions at the mercy of both% floors lower than part 67(a).. If you give a gift so you can an associate away from a consumer’s members of the family, the new current could be considered an indirect provide to help you the customer.

- You’ll have the choice to submit your own setting(s) on line otherwise download a copy to own mailing.

- Listed below are some far more what you should look out for when it comes to a good lender indication-upwards incentive.

- The brand new noncurrent rate enhanced five foundation points from the earlier one-fourth so you can 0.91 %, an even still better below the pre-pandemic average noncurrent speed of 1.twenty-eight percent.

- It quantity of deposit now offers a great balance anywhere between affordability and you can access to a wider list of game, allowing participants to understand more about far more options.

The trick try picking one which fees pair charges when you are delivering a support service and you may a straightforward electronic experience. Due to this we scoured more than three hundred accounts one of nearly 150 creditors for the best of them. NFL BetVision lets consumers weight within the-circle and you may nationally televised NFL game in person in the DraftKings Sportsbook app by the setting a bet on the big event. Found in You.S. jurisdictions where DraftKings Sportsbook works and you may Ontario, Canada, the brand new feature helps bonus wagers and you will remains productive whether or not your wager settles through to the online game ends.

Borrowing People Share Certificates

Weiss added which you’lso are perhaps not usually swinging currency ranging from checking and you will offers profile. As soon as your balance is higher than your own buffer, think animated out of your checking to help you deals. Any money to many other aim otherwise requirements, including an emergency finance, is going to be stored in deals. “You won’t want to feel as if you can spend one currency,” Weiss told you. When you are debit cards advantages aren’t because the glamorous since the handmade cards, you might nevertheless get some good — compared to zero perks generally considering thru bucks deals.

If you’re also someone who utilizes food stamps to aid put dining on the table, then you probably know just how essential it’s to own factual statements about in case your pros was transferred. Knowing the accurate go out their benefits might possibly be readily available might help you finances the trips to market and bundle your diet correctly. Having said that, it’s crucial to understand the procedure for whenever food press try placed in the membership. For those who’re also unsure whether you need to be using or protecting, it’s a valid matter. One another features deserves, and this will very trust the place you’re also in the on the monetary excursion.