Forex Trading for Beginners: Understanding the Basics

Forex trading is an exciting and potentially profitable venture that entices many individuals to step into the world of financial markets. For those who are just starting, the landscape may seem overwhelming. However, with the right knowledge, tools, and resources, you can navigate it effectively. In this article, we will cover the fundamentals of Forex trading and provide valuable insights to help beginners get started. We will also highlight forex trading for beginners Best Indonesian Brokers for your trading journey.

What is Forex Trading?

Forex, or foreign exchange, refers to the global marketplace for trading national currencies against one another. The Forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, the Forex market operates 24 hours a day, five days a week, allowing traders to engage at any time suitable for them.

The Benefits of Forex Trading

Forex trading offers several advantages for beginners, including:

- High Liquidity: The Forex market’s immense size ensures that traders can execute orders quickly and at desired prices.

- Leverage: Many brokers offer leverage, allowing you to control larger positions with a smaller amount of capital.

- Diverse Trading Options: Traders can access various currency pairs, commodities, and other financial instruments.

- 24/5 Market Access: Trading can be conducted at any time, making it flexible for those with day jobs or other commitments.

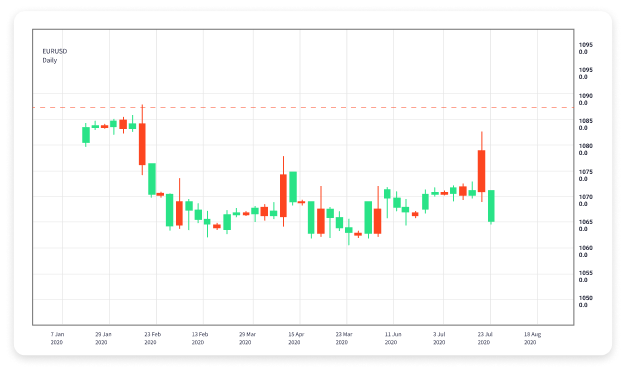

Understanding Currency Pairs

In Forex trading, currencies are always traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is known as the base currency, while the second is the quote currency. The exchange rate denotes how much of the quote currency is required to purchase one unit of the base currency.

For example, if the EUR/USD pair is quoted at 1.20, this means that one Euro can be exchanged for 1.20 US Dollars. Understanding currency pairs is crucial, as it helps traders analyze price movements and make informed decisions.

Basic Forex Terminology

Familiarizing yourself with common Forex terminology is essential. Here are a few key terms:

- Pip: The smallest price change in a currency pair. Most currency pairs are quoted to four decimal places, so one pip is 0.0001.

- Spread: The difference between the bid price (what buyers are willing to pay) and the ask price (what sellers are asking for).

- Lot: The standard unit of measurement for a trade. Forex trading typically occurs in lots, whether they are standard, mini, or micro lots.

- Margin: The amount of money required to open and maintain a leveraged position.

Choosing a Forex Broker

Selecting the right Forex broker is crucial for your trading success. Here are some factors to consider when choosing a broker:

- Regulation: Ensure that the broker is regulated by a reputable financial authority. This adds an extra layer of security for your funds.

- Trading Platforms: Look for a broker that offers a user-friendly trading platform with the tools you need.

- Customer Support: Good customer service is vital, especially for beginners who may need assistance.

- Fees and Spreads: Compare the fees and spreads offered by various brokers to find one that suits your trading style.

Basic Trading Strategies for Beginners

As a beginner, starting with simple trading strategies can help you build your skills and confidence. Here are a few essential strategies:

- Trend Following: This strategy involves identifying and following the direction of market trends. Traders look for upward or downward trends and aim to open positions that align with those trends.

- Range Trading: In a range-bound market, prices fluctuate between a defined high and low. Traders can buy at support levels and sell at resistance levels.

- Breakout Trading: Breakout trading involves identifying key support or resistance levels. Traders enter a position when the price breaks through these levels, indicating a potential price movement.

Risk Management in Forex Trading

Effective risk management is fundamental for long-term trading success. Here are some key risk management strategies:

- Set Stop-Loss Orders: A stop-loss order automatically closes your position at a predetermined price level, helping you limit potential losses.

- Position Sizing: Determine the right amount to risk on each trade, typically no more than 1-2% of your trading capital.

- Diversify Your Portfolio: Instead of placing all your funds in one currency pair, diversify your trades across different pairs to spread risk.

Continuously Educate Yourself

The financial markets are constantly evolving, and so are trading strategies and techniques. It’s essential to stay updated on market news, economic indicators, and trading practices. Consider the following:

- Read Books and Articles: Explore educational resources that cover Forex trading concepts and strategies.

- Join Trading Communities: Engage with other traders in forums or social media groups to share experiences and insights.

- Practice with a Demo Account: Most brokers offer demo accounts where you can practice trading without risking real money.

Conclusion

Forex trading can be an exhilarating journey that offers opportunities for profit and financial growth. By understanding the basics, practicing effective strategies, and managing risks wisely, beginners can pave the way to becoming successful traders. Remember that continuous learning and flexibility are key components of long-term success in Forex trading. Start your journey today, and who knows where the markets might take you!